Life throws unexpected curveballs sometimes. Maybe you need to cover an emergency car repair, pay for a sudden medical bill, or consolidate existing debt. Whatever the reason, a quick and easy way to access funds can be a lifesaver. This is where the Axis Bank Instant Personal Loan comes in. This article will guide you through everything you need to know about this loan option, in simple and clear terms.

Axis Bank Instant Personal Loan

Axis Bank Instant Personal Loan is an unsecured loan offered by Axis Bank, which means borrowers do not need to provide any collateral. Such as their car or house, to qualify for the loan. This type of loan is tailored to provide a swift and convenient solution for accessing funds to address various personal needs.

Whether it’s unexpected expenses, home renovations, medical emergencies, or any other financial requirement, an Axis Bank Instant Personal Loan offers a hassle-free way to secure the necessary funds without the burden of pledging assets as security.

What are the benefits of an Axis Bank Instant Personal Loan?

The benefits of an Axis Bank Instant Personal Loan are manifold, offering borrowers a seamless and rewarding borrowing experience:

- Speed and Convenience: With the ability to apply online 24/7 from the comfort of your home, coupled with minimal documentation requirements and swift approvals, obtaining an Axis Bank Instant Personal Loan is both quick and hassle-free. In many cases, borrowers can expect to receive the funds within the same day of application, ensuring timely access to much-needed finances.

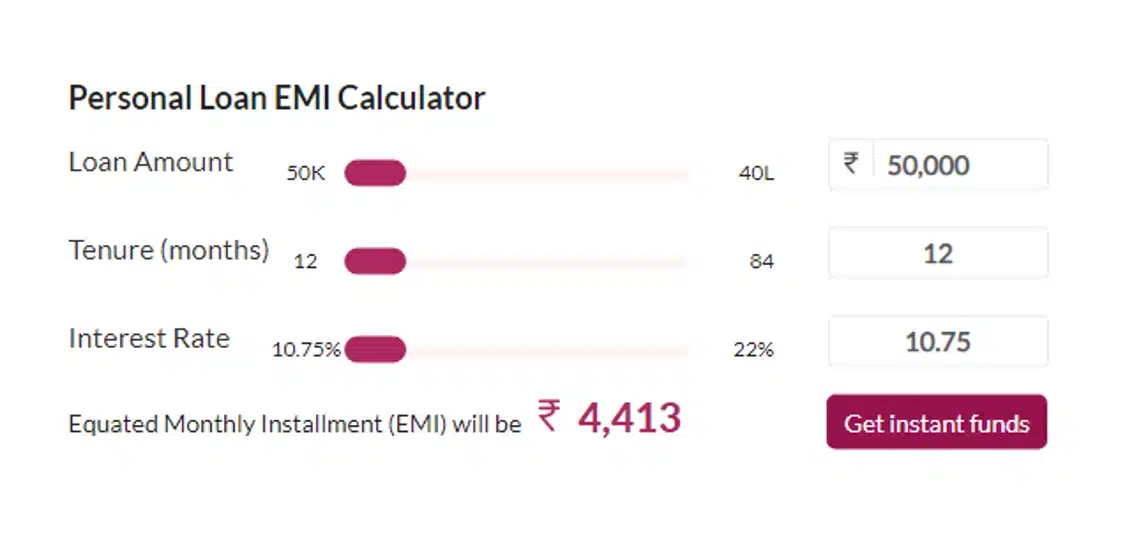

- Flexible Loan Amount: Axis Bank provides instant personal loans ranging from a few thousand rupees to up to ₹40 lakhs, tailored to meet diverse financial needs. The loan amount is determined based on the borrower’s eligibility criteria, ensuring that individuals can access the funds necessary to address their specific requirements effectively.

- Competitive Interest Rates: Axis Bank offers competitive interest rates on its instant personal loans, which vary depending on the borrower’s creditworthiness and the loan amount. This ensures that borrowers can access funds at favorable rates, minimizing the overall cost of borrowing and facilitating affordable repayment.

- Easy Repayment Options: Borrowers have the flexibility to choose a repayment tenure that aligns with their financial capabilities and budgetary constraints. With fixed monthly installments (EMIs), planning and managing repayment become convenient and hassle-free, empowering borrowers to stay on track with their financial obligations.

- No Collateral Required: Unlike certain types of loans that mandate the pledging of collateral, such as cars or houses, an Axis Bank Personal Loan does not necessitate any form of security. This eliminates the risk of losing valuable assets in the event of default, providing peace of mind to borrowers and ensuring a stress-free borrowing experience.

Who is eligible for an Axis Bank Instant Personal Loan?

To qualify for an Axis Bank Instant Personal Loan, individuals must adhere to specific eligibility criteria.

- Firstly, applicants must fall into one of the following categories: salaried individuals, self-employed professionals, or pensioners. Salaried individuals should have a steady income from their employer, while self-employed professionals must demonstrate a stable source of income. Pensioners, on the other hand, should be receiving regular pension payments.

- Secondly, meeting the minimum age and income prerequisites outlined by Axis Bank is crucial. These requirements are subject to change and can vary based on the applicant’s profile and the loan amount sought. Detailed information regarding these criteria can be found on Axis Bank’s official website or by contacting their customer service.

- Thirdly, a commendable credit history is essential. Applicants with higher credit scores often enjoy lower interest rates, making it imperative to maintain a positive credit record by timely repayment of debts and responsible financial behavior.

- Lastly, residency in India is a prerequisite for availing of the loan facility. Non-resident Indians (NRIs) and Persons of Indian Origin (PIOs) may not be eligible for Axis Bank Instant Personal Loans unless specified otherwise by the bank.

By fulfilling these requirements, prospective borrowers can increase their chances of approval for an Axis Bank Instant Personal Loan, providing them with the financial support they require promptly.

How to Apply for an Axis Bank Instant Personal Loan?

Applying for an Axis Bank Instant Personal Loan is a straightforward process, ensuring quick access to funds when you need them. Here’s a step-by-step guide:

- Access Axis Bank’s Website: Navigate to the personal loans section on the Axis Bank website to begin your application process.

- Determine Eligibility: Utilize the online eligibility checker tool provided on the website. This allows you to gauge your eligibility for the loan without impacting your credit score.

- Complete Online Application: Fill out the digital application form, providing essential details such as your income, employment status, and the desired loan amount. This step is designed to be user-friendly and convenient.

- Prepare Minimal Documentation: Axis Bank has streamlined its documentation requirements to ensure a hassle-free experience. Typically, you may need to submit documents such as your PAN card, salary slips (if applicable), and bank statements.

- Expedited Approval Process: Benefit from a swift decision on your loan application, often receiving approval within the same day. This rapid response time underscores Axis Bank’s commitment to efficiency.

- Access Funds Promptly: Upon approval, the sanctioned loan amount will be disbursed directly to your designated bank account within a short timeframe. This ensures that you can access the funds expeditiously, addressing your financial needs without delay.

By following these simple steps, you can seamlessly apply for an Axis Bank Instant Personal Loan, enjoying the convenience and efficiency offered by one of India’s leading financial institutions.

Things to Consider Before Applying

While an Axis Bank Instant Personal Loan can be a helpful tool, it’s important to be responsible with any loan. Here are some things to keep in mind:

- Immediate Financial Needs: If you require swift access to funds to address unexpected expenses, such as medical emergencies or home repairs, an Axis Bank Instant Personal Loan could be an ideal solution. Its quick approval process ensures you get the funds when you need them the most.

- Good Credit Standing: Having a positive credit history is crucial for availing of favorable loan terms. If you possess a good credit score and can comfortably manage the monthly repayments, an Axis Bank Instant Personal Loan offers competitive interest rates and flexible repayment options.

- Unsecured Financing: Unlike secured loans that require collateral, Axis Bank Instant Personal Loans do not necessitate any asset pledging. This makes them suitable for individuals who prefer not to risk their assets or lack valuable collateral.

However, it’s prudent to conduct a thorough comparison of loan offerings from various lenders before finalizing your decision. Consider factors like interest rates, processing fees, and repayment terms to ensure you select the most advantageous option tailored to your requirements.

By carefully evaluating these factors and assessing your financial situation, you can determine whether an Axis Bank Instant Personal Loan aligns with your needs and objectives. Always prioritize informed decision-making to secure the best possible financing solution.

What is The Interest Rate For Axis Bank Personal Loan ?

Navigating personal loan interest rates can be daunting, but with Axis Bank, it’s made clear. The bank offers competitive starting rates, beginning at 10.65% per annum, making it an attractive option for borrowers seeking favorable terms. Your interest rate is tailored to your financial profile, ensuring a personalized experience. Factors like credit score, loan amount, and repayment period influence your final rate. A higher credit score typically means a lower interest rate, while larger loans may come with slightly reduced rates.

Additionally, shorter loan terms often result in lower interest rates. Beyond the interest rate, be aware of potential fees like processing charges and prepayment penalties. Understanding these costs helps you make an informed borrowing decision. With Axis Bank’s transparent approach to interest rates and fees, accessing funds through a personal loan becomes a straightforward and rewarding experience.

Conclusion

In conclusion, the Axis Bank Instant Personal Loan stands out as a convenient and efficient solution for those seeking prompt access to funds. By familiarizing yourself with its advantages, eligibility requirements, and application procedure, you can confidently assess whether this loan option aligns with your financial needs and goals.

With its streamlined application process and rapid approval times, the Axis Bank Instant Personal Loan caters to individuals facing unforeseen expenses or urgent financial requirements. Moreover, its unsecured nature eliminates the need for collateral, offering flexibility and peace of mind to borrowers.

However, it’s essential to conduct a thorough evaluation of your financial situation and compare loan options from different lenders before making a decision. By weighing factors such as interest rates, fees, and repayment terms, you can ensure that the Axis Bank Instant Personal Loan meets your specific requirements and preferences.

Ultimately, armed with knowledge and understanding, you can make a well-informed decision regarding whether to opt for the Axis Bank Instant Personal Loan, confidently navigating your path towards fulfilling your financial objectives.